modified business tax nevada due date

FAQ - Nevada Tax Center General Instructions. TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction.

Select Popular Legal Forms Packages of Any Category.

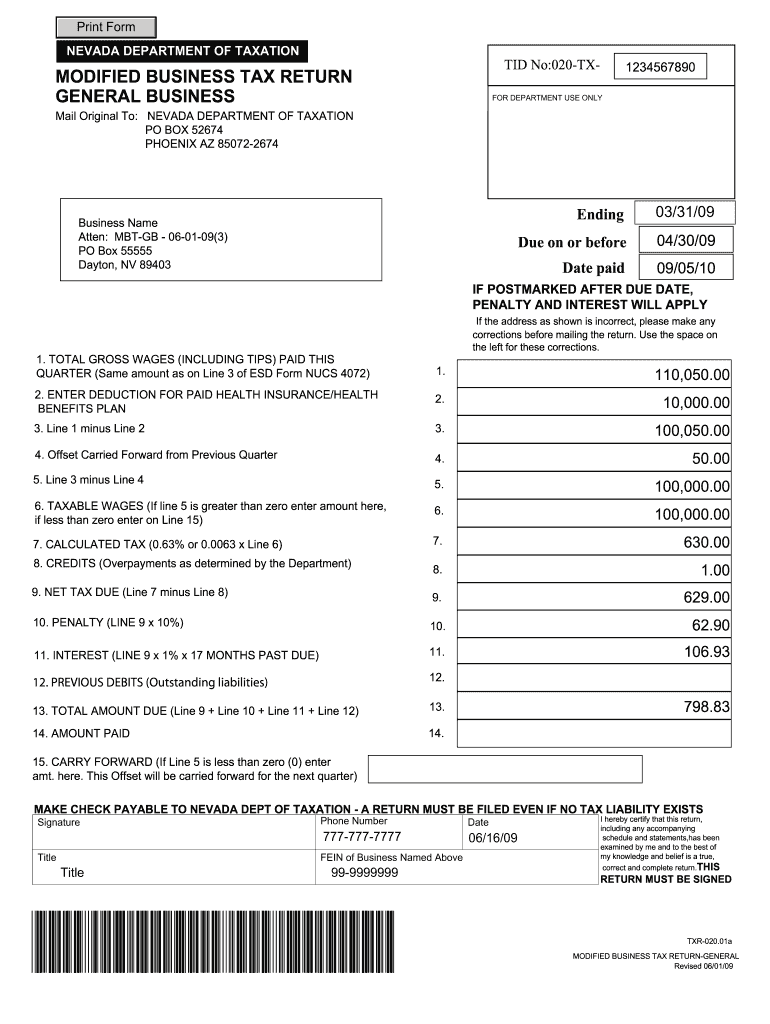

. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. All forms and tax payments are due no later than the last day of the month following the end of the quarter. From now on submit.

Complete Nevada Modified Business Tax 2020-2022 online with US Legal Forms. If you own a business you may be wondering if you need to file a Modified Business Tax Form. The default dates for submission are.

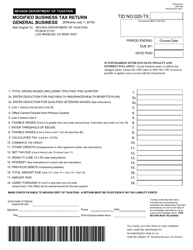

Are You Ready for the Nevada Commerce Tax. General Business u2013 The tax rate for most General Business employers as opposed to Financial Institutions is 1475 on wages after deduction of hEvalth benefits paid by the employer and certain. The Department is developing a plan to reduce the Modified Business Tax rate for quarters ending September 31 2019 through March 31 2021 and will be announcing when refunds will be issued soon.

Add the relevant date. If a tax agency requests a proof of payment or E-file. Our solution allows you to take the entire process of executing legal forms online.

The 2011 Legislative Session pursuant to AB 561 eliminated the Modified Business Tax on any General Business with 62500 or less in taxable wages per calendar quarter after health care deductions. Nevada levies a Modified Business Tax MBT on payroll wages. The new law imposes a 1475 MBT after July 1 2015 and lowers the exemption to 50000 per quarter.

The Modified Business Tax MBT. Q3 Jul - Sep October 31. Effective July 1 2019 the tax rate changes to 1853 from 20.

85000 Exemption less 62500. If you reported payroll over 50000 in any of the above listed quarters you will likely be receiving a notification from the Nevada Department of. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

Due to this you save hours if not days or even weeks and get rid of extra costs. If additional tax is due please remit payment along with applicable penalty and interest. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries such as financial institutions paid a higher rate.

Modified Business Tax has two classifications. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. People also ask nevada modified business tax due dates.

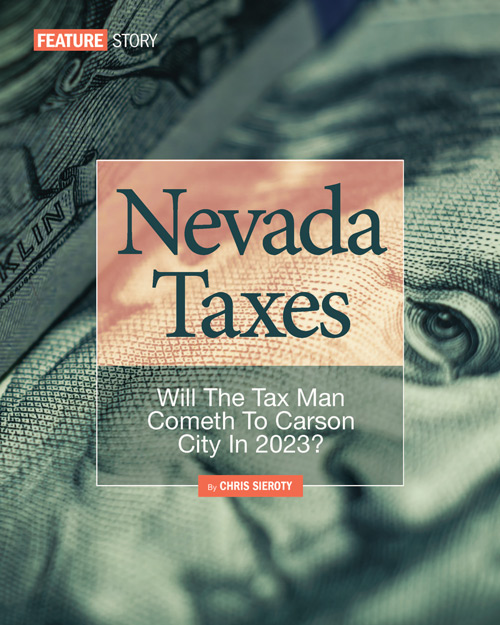

Financial institutions subject to the MBT-FI are defined in NRS 363A050. Email the amended return along with any additional documentation to email protected OR mail your amended return to. The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and were not reduced to 1378 and 1853 respectively.

In 2021 the commerce tax accounted for 28 percent of total tax revenues compared to 69 percent from sales and use taxes while 35 percent is raised from the net proceeds of the minerals tax and 75 percent from the modified business tax. The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in Nevada who may have an existing tax liability. Tax Due under 62500 Exemption Annual MBT Tax Due under 85000 Exemption Difference in Annual Tax Due.

What is the Nevada modified business tax. All Major Categories Covered. In this post well go over what the Modified Business Tax Form is and who needs to file it.

Q1 Jan - Mar April 30. The amnesty period will begin Feb. Easily fill out PDF blank edit and sign them.

How do I change my modified business tax return in Nevada. Q2 Apr - Jun July 31. There are no changes to the Commerce Tax credit.

This form is for businesses with income over 1 million and its used to figure out your tax liability. For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation. PdfFiller allows users to edit sign fill and share all type of documents online.

Nevada Tax Form Modified Details. Department of Taxation 1550 College Parkway Suite 115 Carson City NV 89706. The annual tax has been revised over the years with it currently applying to any business that exceeds.

Modified Business Tax Return-Mining 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for businesses who are subject to the tax on the Net Proceeds of Minerals imposed pursuant to NRS 362. PO Box 7165 San Francisco CA 94120-7165. The DOT has been ordered to refund to businesses the excess tax collected plus interest from the date of collection.

Filing Period Due Date Extended Due Date.

Form Txr 020 05 Mbt Gb Download Fillable Pdf Or Fill Online Modified Business Tax Return General Business Nevada Templateroller

Modified Business Tax Form Fill Out Printable Pdf Forms Online

Nevada Taxes Will The Tax Man Cometh To Carson City In 2023 Nbm

Modified Business Tax Return Financial Institutions

Modified Business Tax Return Financial Institutions

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

2022 Federal Tax Deadlines For Your Small Business

How To File And Pay Sales Tax In Nevada Taxvalet